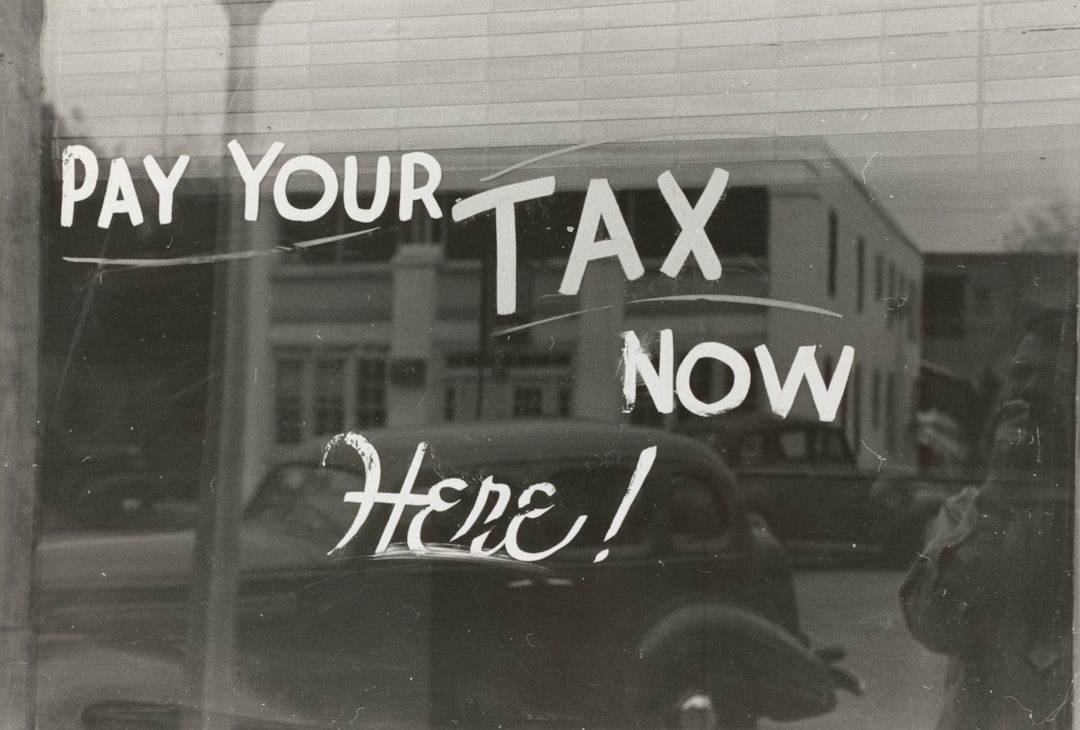

Passive Profits Blueprint Legal and Tax Essentials

Every stream of passive income you generate carries with it a legal and tax responsibility that can shape the long-term health of your portfolio. Ignoring these fundamentals is like building a house on sand great in theory, but destined to fail when the ground shifts. In the next sections we’ll walk through the structures that protect you, the tax rules that apply to earnings, and the compliance habits that keep the IRS satisfied.

Legal Structures for Passive Income

Choosing the right legal entity is the first line of defense against liability and a key lever for tax efficiency. Most passive investors start with a Limited Liability Company (LLC) because it offers flexibility and limited personal exposure. An LLC can be a single-member entity or a multi-member partnership, and its profits pass through to your personal return, avoiding double taxation.

If you expect to generate substantial income and need to attract investors, an S‑Corporation may be preferable. By electing S‑Corp status you can treat yourself as a “reasonable salary” employee and pay yourself wages, while the remaining profits flow through unchanged to your personal tax return. This can reduce self‑employment tax on the larger portion of the income.

For real estate ventures, a Series LLC can separate each property into its own “series” while keeping a single master entity. This limits liability between properties and keeps administrative overhead low.

When forming an entity, you must file the appropriate articles of organization or incorporation with your state, pay the filing fee, and create an operating agreement that spells out ownership, profit sharing, and dissolution procedures. Even a one‑person LLC requires an operating agreement to establish credibility with lenders and partners.

Tax Basics for Passive Income

Passive income whether from rental real estate, dividends, or a limited partnership does not automatically fall under ordinary income rules. The IRS classifies it as “passive” because you are not actively managing the venture. That distinction matters for the passive activity loss (PAL) rules: losses from passive activities can only offset other passive income, not wages or active business profits, unless you meet the “active participation” threshold.

The key tax brackets for passive income depend on its nature. Dividend income is taxed at qualified rates 0%, 15%, or 20% depending on your overall taxable income. Rental income is considered passive, but if you actively manage the property, you may qualify for the real estate professional exception, which lets you deduct losses against non‑passive income. Capital gains from the sale of a passive asset are taxed at 0%, 15%, or 20% rates for long‑term gains, while short‑term gains are taxed at ordinary rates.

Tax‑deferred accounts can shelter passive income. Placing dividends in a Roth IRA eliminates future taxes entirely, while a Traditional IRA defers them until withdrawal. However, investment choices are limited in retirement accounts; you must stay within the available funds.

Proper tax planning also involves estimating quarterly payments. Because passive income is usually not subject to withholding, you must make estimated tax payments to avoid underpayment penalties. Use IRS Form 1040‑ES or the TaxCaster tool to estimate your liability based on current and projected income.

Compliance & Record-Keeping

Beyond filing returns, maintaining meticulous records is your best defense against audit. The IRS requires that you keep receipts, invoices, bank statements, and any documents that support your income and expenses for at least seven years. The “seven‑year rule” applies because the IRS can add tax for a prior year if the return is fraudulent, and the statute of limitations is six years (plus one year for fraud).

For each passive asset, create a separate ledger that tracks:

- Source of income (e.g., rent, dividends, royalties)

- Expense categories (maintenance, property management, interest)

- Depreciation schedules

- Partner contributions and distributions

Digital tools like QuickBooks Self‑Employed or specialized real estate software (e.g., Stessa) can automate many of these tasks. Even if you outsource bookkeeping, keep copies of all correspondence and reports.

Compliance extends to local regulations as well. Rental properties must meet health and safety codes; failure to comply can lead to fines and lawsuits. Business licenses, zoning permits, and environmental assessments (for large developments) are also required. Ignoring these can jeopardize the entire venture.

Advanced Strategies and Future Outlook

Once you have the foundational structures and tax plan in place, you can start layering advanced strategies to enhance returns and further protect your assets. One such strategy is the use of cost segregation studies for real estate. By reallocating the cost basis of a property into shorter depreciation periods like 5, 7, or 15 years you can accelerate deductions and free up cash flow in the early years of ownership.

Another powerful tool is the creation of a holding company that owns multiple passive investment entities. This layer allows you to segregate risk and simplifies the management of diverse portfolios. For example, a holding company could own an LLC that holds rental properties, a partnership that owns a private equity fund, and a trust that manages dividend-paying stocks. Each layer can be tailored to its tax treatment and regulatory environment.

Tax law is not static. Recent proposals, such as the expansion of the Alternative Minimum Tax (AMT) or changes to capital gains rates, can alter the calculus for passive investors. Staying informed through reputable sources IRS updates, tax advisors, and industry newsletters ensures you can pivot before new rules take effect.

Furthermore, consider the strategic use of tax‑loss harvesting. If a passive asset dips below its purchase price, selling it can create a loss that offsets other passive income. Combine this with a like‑for‑like exchange (1031 swap) to defer capital gains on real estate while still capturing a loss on your tax return.

In the digital age, passive income streams such as royalty collections, affiliate marketing, and SaaS licenses bring their own set of compliance challenges. The Digital Services Tax (DST) in some jurisdictions imposes new withholding requirements on online revenue. Early integration of these rules into your accounting system prevents costly surprises.

The final piece of the puzzle is mindset. Treat passive income as a living portfolio that requires active oversight, even if the day‑to‑day management is outsourced. Schedule quarterly reviews of each entity’s performance, tax position, and legal status. When you see a new opportunity like a distressed property or a high‑yield dividend stock evaluate it against your risk tolerance and existing structure before committing capital.

In conclusion, building a passive income empire is as much about legal and tax strategy as it is about generating cash. By selecting the right entities, mastering tax classifications, maintaining rigorous records, and adopting advanced planning tools, you position yourself for sustainable growth and long‑term protection. The effort you invest today in legal and tax preparedness will pay dividends literally and figuratively well into the future.

Jay Green

I’m Jay, a crypto news editor diving deep into the blockchain world. I track trends, uncover stories, and simplify complex crypto movements. My goal is to make digital finance clear, engaging, and accessible for everyone following the future of money.

Discussion (6)

Join the Discussion

Your comment has been submitted for moderation.

Random Posts

Passive Income Projects Using Crypto Affiliate Programs for Huge Earning Potential

Discover how crypto affiliate programs can create recurring passive income by driving users to exchanges, wallets, and DeFi platforms. Learn to pick top partners, automate, and scale your earnings.

8 months ago

Your Ultimate Guide to Staking Tools and Real‑Time Alerts

Unlock passive crypto income with staking: learn how real time alerts, automated tools, and smart monitoring help you maximize rewards, stay ahead of yield swings, and avoid security pitfalls.

9 months ago

Navigating International Laws for Passive Income with Legal and Tax Guidance

Master passive income across borders by understanding legal structures and tax rules that prevent non, compliance, double tax, and protect your profits.

2 weeks ago

Community Voice Drives Affiliate Growth Through Dialogue

Listening to real community conversations turns affiliate marketing from a sales push into a trust based partnership, boosting traffic and conversions through authentic dialogue.

1 year ago

Mastering Support and Resistance in Technical Market Analysis

Learn how to spot pivot points and draw reliable support and resistance lines to turn market noise into clear trading signals.

8 months ago

Latest Posts

Tax Strategies for Long Term Passive Earnings

Learn how smart tax planning can boost your passive income: choose efficient vehicles, use shelters, time gains, and keep more of what you earn.

1 day ago

Passive Income Education Through Legal, Tax, and Risk Management

Turn a side hustle into lasting, hands, off wealth by mastering legal structure, tax strategy, and risk protection, the three pillars that safeguard capital and ensure steady dividends.

1 day ago

Crypto Exchange Basics for Steady Income

Build steady crypto income by defining clear goals, choosing the right exchange tools, and sticking to a disciplined strategy for consistent returns.

2 days ago