Achieving Financial Freedom with Passive Income Principles and Tax Insight

Financial freedom is no longer an abstract dream; it can become a realistic goal when you combine smart passive income strategies with a solid grasp of tax rules. Passive income streams are not “set it and forget it” – they require thoughtful planning, disciplined execution, and an awareness of how the tax code can either boost or erode your returns. In this guide, we’ll break down key passive income concepts, outline practical ways to build a diversified income portfolio, and share actionable tax insights that help you keep more of what you earn.

Understanding Passive Income

Passive income refers to earnings that require minimal day‑to‑day management once the initial effort is completed. Classic examples include rental properties, dividend‑paying stocks, peer‑to‑peer lending, digital products, and certain business arrangements. What unites these channels is that they generate cash flow with limited ongoing effort. This is a powerful idea because it allows you to earn while you sleep, freeing up time for growth, creativity, or simply rest.

A well‑balanced passive income plan typically incorporates multiple streams. Diversification protects against the volatility of any single asset class. For instance, if real estate markets soften, dividend stocks may still provide a steady dividend yield, while a digital course could bring in royalties. When building such a portfolio, begin with a clear set of goals: how much monthly cash flow do you need? How much risk are you willing to tolerate? And importantly, how much capital can you deploy initially?

Building a Passive Income Pipeline

The first step in creating a pipeline is identifying which passive income vehicles align with your skill set and resources. If you have real estate experience, rental properties can be a direct entry point. If you enjoy reading, compiling a library of e‑books or courses can generate royalty income. Each vehicle has distinct upfront costs, operational responsibilities, and return expectations.

A step‑by‑step approach can help you scale your efforts efficiently. Start by allocating a small portion of your savings say, 10–15% to a high‑yield investment like a dividend fund or a low‑maintenance real estate trust. Next, research the operational details: for rentals, consider property management services; for digital products, explore platforms that handle delivery and customer support. As you see which channels generate the best risk‑adjusted returns, you can reinvest those profits to compound growth over time.

Another key tactic is to automate wherever possible. Automating dividend reinvestment plans, setting up automatic contributions to a rental property’s maintenance fund, or using a digital platform that auto‑updates content can turn a once‑handcrafted effort into a low‑touch engine of income. Automation not only saves time but also ensures consistency an essential factor for long‑term success.

Tax Insight and Strategies

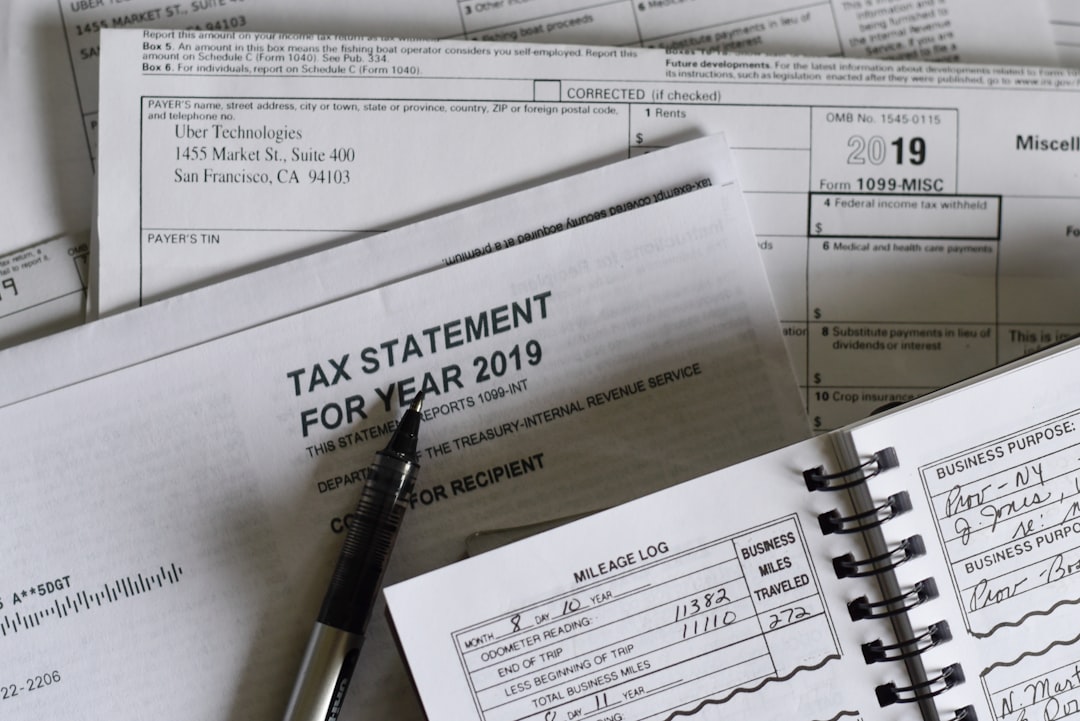

Taxes can either serve as a lever or a barrier in your passive income journey. Understanding the tax treatment of different income types is crucial for maximizing net returns. Generally, passive income falls into a few categories: qualified dividends, capital gains, rental income, and royalties. Each is taxed at different rates and may qualify for special deductions.

For example, qualified dividends and long‑term capital gains often enjoy lower tax brackets compared to ordinary income. Rental income, on the other hand, is taxable, but you can offset it with legitimate expenses such as mortgage interest, property taxes, depreciation, and maintenance costs. This “passive loss” rule can reduce your overall tax bill if you have enough other income to absorb the loss. However, the IRS imposes limitations on how much passive loss you can deduct in a single year, especially if your modified adjusted gross income exceeds certain thresholds.

Tax‑efficient strategies also involve timing. Holding an investment for more than a year to qualify for long‑term capital gains rates can dramatically lower your tax outlay. For real estate, timing the sale of a property after a significant appreciation period can trigger a lower capital gains tax if you can qualify for a 1031 exchange a powerful tool that allows you to defer taxes by reinvesting proceeds into a like‑kind property.

Additionally, consider tax‑advantaged accounts. Contributing to an IRA or a 401(k) can shelter passive investment returns from immediate taxation. Some investors use self‑directed IRAs to hold real estate or private equity, providing both growth potential and tax deferral. The key is to balance the flexibility of taxable accounts against the tax shelters of retirement accounts, aligning each vehicle with your overall timeline and liquidity needs.

The next stage is to review your overall tax exposure and identify deductions and credits that you might be missing. For instance, if you own rental properties, you can claim depreciation a non‑cash deduction that lowers taxable income. Similarly, if you invest in certain municipal bonds, the interest income may be exempt from federal and sometimes state taxes. Small details like these can compound significantly over time.

It’s also essential to stay up‑to‑date with tax law changes. New legislation can alter the thresholds for capital gains rates, introduce new deductions, or adjust the rules governing passive activity losses. Keeping a quarterly conversation with a tax professional or subscribing to reputable finance newsletters ensures you’re not caught off guard.

Beyond the mechanics, cultivating a mindset of tax efficiency can shift how you allocate capital. Instead of chasing the highest nominal return, evaluate the after‑tax return. A modestly performing investment that offers a favorable tax treatment may outperform a high‑yield vehicle that is heavily taxed.

In the grand scheme, the synergy between passive income streams and smart tax planning unlocks the potential for sustainable wealth creation. By methodically building diverse income sources, automating operations, and continuously refining tax strategies, you transform each dollar earned into a multiplier that works for you. The journey to financial freedom is incremental, but the payoff freedom to pursue your passions, to spend time with loved ones, and to secure a legacy makes every step worthwhile.

Jay Green

I’m Jay, a crypto news editor diving deep into the blockchain world. I track trends, uncover stories, and simplify complex crypto movements. My goal is to make digital finance clear, engaging, and accessible for everyone following the future of money.

Discussion (8)

Join the Discussion

Your comment has been submitted for moderation.

Random Posts

Future-Focused Investing - Turning Objectives into Wealth

Turn vague dreams into wealth by setting SMART goals, defining exact amounts and timelines, then disciplined planning and investing that grows with you.

1 year ago

Beyond Short Term Fluctuations Crafting a Long Term Investment Roadmap

Ignore short term swings. Build a long term roadmap that ties your investments to life goals, turning volatility into an ally that steadily grows your wealth over time.

4 months ago

Diversification Strategies That Improve Risk Adjusted Returns

Learn how smart diversification, beyond simple spread, boosts Sharpe and Sortino ratios, protecting growth while smoothing volatility.

10 months ago

Smart NFT Strategies for Reliable Income and Tax Efficiency

Build a passive NFT portfolio with diverse assets, smart royalty management, and tax, aware structuring to turn tokens into reliable income while keeping taxes low.

1 week ago

Integrating Wallets with Staking Tools Step by Step

Learn how to connect your wallet to staking tools in clear, simple steps, update firmware, secure your seed, choose a trusted platform, and start earning rewards safely.

1 month ago

Latest Posts

Tax Strategies for Long Term Passive Earnings

Learn how smart tax planning can boost your passive income: choose efficient vehicles, use shelters, time gains, and keep more of what you earn.

1 day ago

Passive Income Education Through Legal, Tax, and Risk Management

Turn a side hustle into lasting, hands, off wealth by mastering legal structure, tax strategy, and risk protection, the three pillars that safeguard capital and ensure steady dividends.

1 day ago

Crypto Exchange Basics for Steady Income

Build steady crypto income by defining clear goals, choosing the right exchange tools, and sticking to a disciplined strategy for consistent returns.

2 days ago